You can make more requests on paper, preferably using Form T1-ADJ, T1 Adjustment Request, and mail them to the CRA.

#Resend 2015 turbotax return how to

If you go over the limit, you will get an automated response saying the limit has been reached and explaining how to send a paper request. The online system accepts only nine adjustments per tax year for each taxpayer, whether a taxpayer, service provider, or the CRA does the adjustments. Use My Account to make changes to the following information: You cannot use ReFILE to make changes to personal information on page 1 of an income tax and benefit return. the first return was filed by the CRA as a 152(7) assessment.is subject to provincial or territorial income tax in more than one jurisdiction.has a first return that has not been assessed (you can view the Express Notice of Assessment (NOA) view the regular NOA on Represent a Client or My Account for Individuals or have a paper NOA on hand to validate that a return has been assessed).is applying for the disability tax credit.

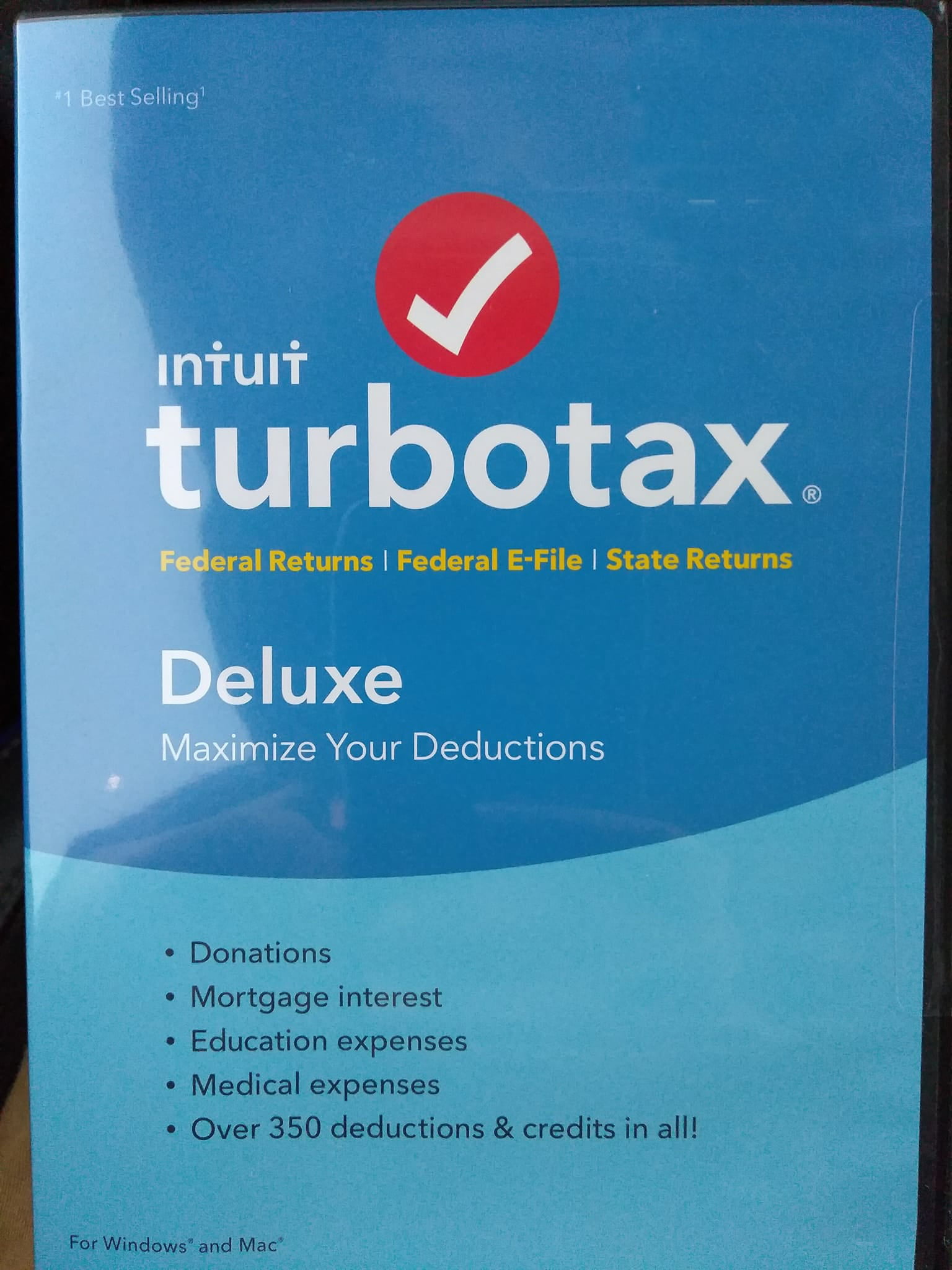

#Resend 2015 turbotax return software

You use certified EFILE software with ReFILE.This means you were accepted to use EFILE, or your EFILE privileges have not been suspended or revoked. You are an EFILE service provider in good standing with the CRA.You can use ReFILE if the following conditions apply: Otherwise, you will have to mail a paper Form T1-ADJ, T1 Adjustment Request, to the Canada Revenue Agency (CRA). If you did not file your return online, you can use Change my return (CMR) which is a secure My Account service that allows you to make an online adjustment. Use ReFILE with the same certified NETFILE software you used for filing your income tax and benefit return. Simple – You can use the software you like.

0 kommentar(er)

0 kommentar(er)